2025–2026 China Bridge Crane & Gantry Crane Exports Overview

2025–2026 China Bridge and Gantry Crane Export Overview & Buyer Insights

Executive Summary

In 2025, China’s bridge and gantry crane exports continued to show steady growth, but the picture was a bit mixed depending on the product type and market. Bridge cranes maintained strong performance overall, while gantry cranes saw a “slow start, strong finish” pattern, reflecting project deliveries and seasonal demand cycles.

The main takeaway is that non-US markets drove most of the growth, while exports to the United States faced continued pressure from trade barriers and slower industrial investment. For buyers and industry observers, understanding these trends helps plan purchases, anticipate delivery schedules, and select the right crane type for specific operational needs.

Key Trends

- High-growth markets: ASEAN countries, Belt & Road nations, Africa, and the Middle East were the main sources of export growth. These regions benefited from infrastructure projects, industrial expansion, and regional trade agreements like RCEP.

- Product upgrades: Smart and automated cranes, including features like remote monitoring, anti-sway systems, and predictive maintenance, grew faster than conventional models. Large-tonnage and special-purpose cranes also saw higher demand in energy, port, and heavy manufacturing projects.

- Market challenges: Exports to the US continued to decline, mainly due to trade barriers and certification requirements. Steel price fluctuations and intense price competition in economic crane models also affected margins.

Core Conclusion

- Non-US markets are leading the growth, making up the majority of export gains.

- US exports are falling, showing the limits of high-tariff and restricted markets.

- Diversifying into emerging markets helps balance risk and ensures more stable order flows.

- Buyers can benefit from understanding these patterns by selecting suppliers with local support, smart crane technology, and modular designs to match project and budget needs.

Export Scale and Growth (2025)

Overhead Bridge Cranes

In 2025, China's bridge crane exports remained strong, driven by emerging market demand and ongoing industrial expansion. Both traditional single/double girder and electric hoist bridge cranes contributed to growth, with mid-size cranes being the most popular for factories, warehouses, and ports.

Export Volume and Value

Exports in the first half of the year reflected steady order placement from regional projects and factory expansions. Buyers were particularly active in Southeast Asia and Belt & Road countries.

- Jan–Jun 2025: 1.03 million units of electric hoist bridge cranes exported

- Total value for the same period: $1.94 billion

- Full-year projection: approximately 60 billion RMB

Year-over-Year Growth

The overall growth trend shows that bridge cranes are still a reliable export product, even in the face of raw material fluctuations and global shipping challenges.

- Overall growth: +12.3% YoY

- Growth driven by Southeast Asia, Belt & Road countries, and selected Middle Eastern markets

- Electric hoist bridge cranes dominate due to flexibility, reliability, and suitability for mid-sized production facilities

Quarterly Trends and Market Dynamics

Export activity varied across quarters, reflecting seasonal project schedules and regional demand differences.

Q1 & Q2: Strongest growth phase

- Orders surged due to new factory setups and port projects

- Southeast Asia benefited from RCEP tariff reductions

Q3: Stable volume

- Steady orders from ongoing factory maintenance and seasonal construction

Q4: Slight slowdown

- Growth moderated due to steel price volatility and logistics costs

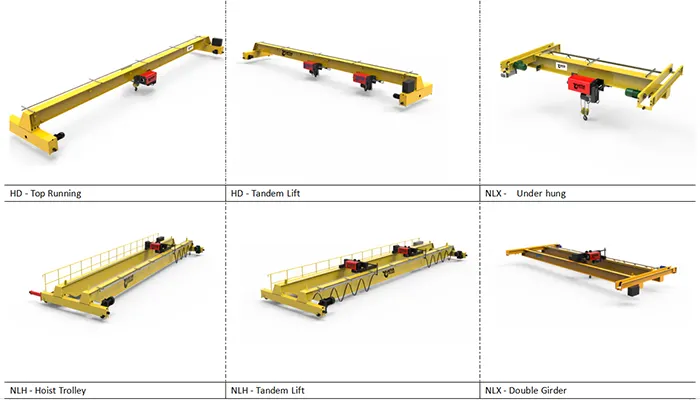

Product Segmentation

Understanding which crane types are most in demand helps buyers match capacity with operational needs.

- Electric Hoist Bridge Cranes: Most exported, suitable for mid-sized factories and warehouses

- Single/Double Girder Bridge Cranes: Single girder for smaller spans and lighter loads, double girder for heavy-duty or long-span operations

- Specialized Variants: Heat-resistant and corrosion-resistant models for industrial and port environments

Practical Insights for Buyers

Timing and product selection are critical to maximizing value when purchasing bridge cranes.

- Timing Matters: Order in Q1–Q2 for better pricing and delivery

- Price Planning: Account for steel price and shipping cost fluctuations

- Crane Selection: Single girder for cost efficiency, double girder for heavy duty, electric hoist cranes for versatility

- Local Support: Choose suppliers with overseas service centers

Overall Market Outlook

Overall, bridge cranes were a stable and growing segment of China's crane exports in 2025. Buyers who understand quarterly trends, market demand, and product segmentation can plan more effectively for reliable delivery and long-term operational efficiency.

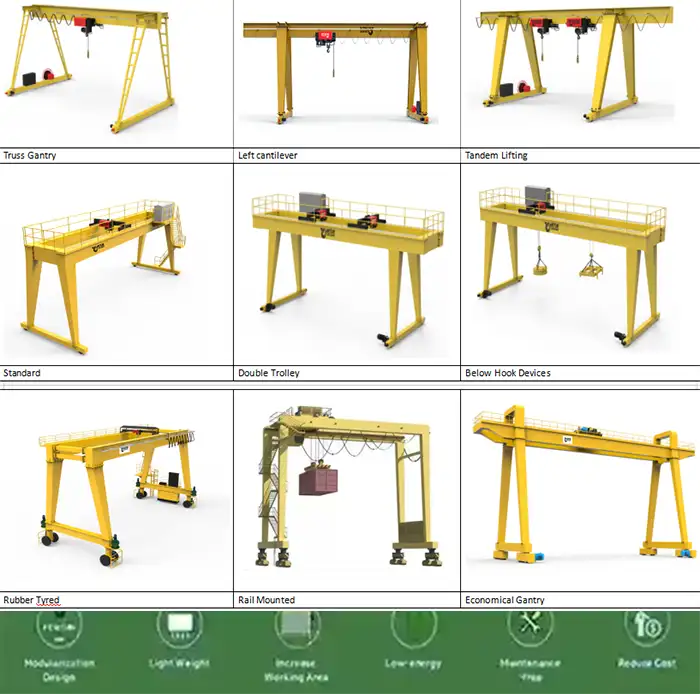

Gantry Cranes

Gantry crane exports in 2025 showed a more dynamic and project-driven pattern compared with bridge cranes. The fluctuations were largely influenced by concentrated project deliveries, seasonal demand, and large infrastructure contracts. For buyers, understanding these trends is critical to planning orders, ensuring timely delivery, and managing costs.

Total Export Value

Despite early-year challenges, gantry crane exports ended the year on a positive trajectory, reflecting strong project-based demand in key markets.

- Total export value: $750 million

- Year-over-year growth: +8%

- Growth driven mainly by emerging markets including Southeast Asia, Belt & Road countries, Africa, and the Middle East, where industrial expansion and port development projects supported high-capacity crane demand

Monthly and Seasonal Trends

Export volumes were uneven throughout the year, reflecting the timing of major deliveries rather than consistent monthly demand. Buyers need to anticipate these peaks to align procurement schedules.

- Jan–Sep: Lower export volume due to project start delays, raw material fluctuations, and logistical constraints

- September: Massive spike, +331% YoY, driven by concentrated deliveries of port, energy, and heavy industry projects

- Seasonal trends indicate that Q3–Q4 is often the busiest period, coinciding with infrastructure and industrial project milestones

Average Export Price

The variety of gantry cranes exported means prices vary significantly depending on capacity, technology, and application. Buyers should match the crane type to operational needs for optimal value.

- Average price per unit: $120,000

- Large-tonnage or smart/automated gantry cranes: >$200,000 per unit, typically used for ports, energy projects, or heavy manufacturing

- Standard economic models: $50,000–$80,000 per unit, suitable for warehouses, light manufacturing, or mid-size operations

Project-Driven Demand and Fluctuation

Gantry crane exports are highly project-dependent, with delivery schedules dictating spikes and dips in monthly shipments. Understanding this pattern is crucial for buyers to avoid delays and optimize procurement timing.

- Major port expansions, infrastructure projects, and industrial facility upgrades often concentrate crane deliveries in a single month or quarter

- Buyers who align orders with project timelines can reduce storage costs and minimize downtime

- Selecting modular or customizable gantry cranes allows better flexibility for phased project deployment

Practical Insights for Buyers

Planning and product selection are essential to ensure operational efficiency and cost control. Buyers who understand the seasonal and project-driven nature of gantry crane exports can optimize their purchasing strategy.

- Plan ahead: Place orders several months before project milestones to ensure delivery

- Match crane type to project needs: Large-tonnage cranes for heavy industry, smart/automated cranes for precision or port operations

- Budget realistically: Factor in price differences between standard models and high-capacity, automated solutions

- Monitor delivery windows: Avoid months with historically high shipments to prevent delays or higher costs

Key Takeaways

Gantry crane exports in 2025 were project-driven, with strong growth in emerging markets and concentrated monthly delivery peaks. Buyers who understand monthly trends, price segmentation, and project-driven demand can make more informed procurement decisions, securing the right crane type at the right time.

Core Export Markets

China’s crane exports in 2025 were driven largely by emerging and Belt & Road markets, while mature markets like the US showed continued weakness. Understanding which markets are growing and what products are in demand helps buyers align procurement strategies with availability, delivery schedules, and operational needs.

Market Breakdown

Each export market has distinct growth drivers and product preferences. Recognizing these differences allows buyers to choose suppliers, crane types, and timing more effectively.

ASEAN (Vietnam, Indonesia, Thailand, etc.)

Southeast Asia remained a high-growth market thanks to industrial expansion and port development, aided by RCEP trade benefits. Mid-size cranes are in particular demand due to the prevalence of medium-scale factories and warehouses.

- Growth: 13–40%

- Share: 35–40% of total exports

- Drivers: RCEP agreements, industrial and port expansion

- Products: Single/double girder bridge cranes, mid-size gantry cranes

Belt & Road Countries

Belt & Road nations continue to drive demand for large-tonnage and automated cranes. Infrastructure projects and logistics corridors require high-capacity, reliable cranes that can handle heavy industrial loads.

- Growth: 10–18%

- Share: 48–51%

- Drivers: Infrastructure projects, logistics corridors (e.g., railways, ports)

- Products: Large-tonnage, smart/automated cranes

Middle East

The Middle East market grew steadily, fueled by port expansions and renewable energy projects. Buyers increasingly request cranes that can withstand high temperatures and harsh environments.

- Growth: 10–25%

- Share: 10–12%

- Drivers: Port development, renewable energy projects

- Products: Heat-resistant, large-tonnage cranes

Africa

Africa remains a fast-growing market due to resource development and civil infrastructure projects. Economic or customized gantry cranes are preferred, balancing cost with local conditions and operational flexibility.

- Growth: 22–28%

- Share: ~10%

- Drivers: Resource extraction, civil infrastructure, and industrial development

- Products: Economic and customized gantry cranes

European Union

EU demand is more selective, with buyers focused on Industry 4.0 upgrades and precision manufacturing. Smart and automated cranes command higher prices but also offer operational efficiency and safety advantages.

- Growth: 5–9%

- Share: 7–8%

- Drivers: Industrial modernization, Industry 4.0 upgrades

- Products: Precision and smart cranes

United States

US exports continued to decline, reflecting trade barriers, certification requirements, and slower industrial investment. Demand is largely limited to replacement or high-value cranes that meet strict standards.

- Growth: -15 to -18.9%

- Share: 4–5%

- Drivers: Trade barriers, slower investment

- Products: High-value replacement cranes

Observations

Looking across markets, several patterns emerge that are useful for crane buyers and planners:

- Non-US markets drive growth: ASEAN, Belt & Road countries, Africa, and the Middle East are responsible for most export volume gains. These regions offer stable demand and shorter lead times for buyers.

- US exports continue to decline: Trade barriers and slower industrial investment limit growth potential in mature markets. Buyers targeting the US should anticipate higher compliance costs and limited product availability.

- Seasonal and project-driven fluctuations: Monthly export volumes are strongly influenced by infrastructure, port, and industrial project schedules, meaning buyers must align orders with these delivery cycles to avoid delays.

Practical Takeaways for Buyers:

- Focus procurement on emerging markets to access faster delivery, more flexible product options, and cost advantages.

- For large or smart cranes, Belt & Road and Middle Eastern markets often provide the latest technology and high-capacity models.

- Monitor seasonal project trends to avoid peak-month bottlenecks in delivery schedules.

- Consider local service support and installation capabilities, especially in Africa and ASEAN regions, to reduce operational downtime.

Product Structure & Competitive Landscape

China’s crane exports in 2025 show a clear diversification in product offerings, with different types of cranes meeting varying industrial and regional needs. Understanding the product structure and competitive landscape helps buyers select the right supplier and model for their operations.

Product Breakdown

Crane exports are no longer dominated by a single type; instead, multiple categories coexist, each tailored for specific markets and applications. Buyers should consider both application needs and budget when choosing a crane.

Traditional Cranes

Traditional single- and double-girder cranes remain the backbone of exports. These models are cost-effective, reliable, and widely used in mid-sized factories and general logistics operations.

- Share of exports: 55–60%

- Applications: Mid-sized industrial plants, general warehouse and logistics use

- Key features: Reliable lifting, moderate maintenance requirements, adaptable to most production floors

Smart and Automated Cranes

Smart cranes are increasingly popular, especially in high-end industrial and European/Middle Eastern markets. These cranes integrate remote control, anti-sway technology, and automatic positioning, offering safer and more precise operations.

- Share of exports: 25–30%+

- Applications: Precision manufacturing, automotive, electronics, ports requiring automation

Features & advantages:

- Remote monitoring and control

- Anti-sway for safer lifts

- Automatic positioning for efficiency

- Typically 20–30% higher price due to advanced technology

Large-Tonnage & Special-Purpose Cranes

Large-tonnage and special-purpose cranes address heavy industry needs, including metallurgy, wind power, and shipbuilding. These cranes often exceed 20–50 tons in lifting capacity and are tailored to project-specific requirements.

- Growth: 15–18% YoY

- Applications: Metallurgical plants, wind farms, shipyards, heavy construction sites

- Advantages: High load capacity, long service life, suitable for demanding environments

Container & Port Automation Cranes

Port and container cranes represent a high-growth segment, driven by automated logistics projects worldwide. These cranes are often integrated into full port automation systems, demanding both precision and reliability.

- Growth trend: Rapid, especially in Singapore, Turkey, and Middle Eastern ports

- Applications: Container terminals, automated cargo handling

- Key features: High-speed operation, automation-ready, long-span design

Competitive Landscape

The crane export market is highly segmented, with different types of companies focusing on specific niches. Buyers benefit from understanding which suppliers specialize in cost, technology, or high-end turnkey solutions.

Head Enterprises

Leading companies like XCMG, Zoomlion, Sany, and Weihua dominate high-value segments, offering turnkey solutions and strong local support overseas.

- Strengths: Turnkey projects, local service centers, high technical reliability

- Best suited for buyers: Those requiring large projects, custom engineering, and ongoing maintenance

Cluster Companies

Regional clusters in Henan and Jiangsu focus on cost-effective solutions with fast delivery, particularly for ASEAN and African markets. These companies leverage volume and localized production to compete effectively.

- Strengths: Competitive pricing, fast lead times, adaptable to mid-size industrial projects

- Best suited for buyers: Those prioritizing budget efficiency and standard configurations

European & US Brands

Western brands focus on ultra-high-end markets, such as semiconductor and aerospace applications. In contrast, Chinese manufacturers are increasingly capturing the mid- to high-end segments with smart and automated cranes.

- Strengths: Ultra-precision, premium materials, specialized applications

- Market insight: China now leads mid- and high-end smart/automated crane exports, especially in emerging markets where local service and turnkey capabilities are valued

Key Takeaways for Buyers

- Understand your operational needs: mid-size factory, heavy industry, port automation, or precision manufacturing

- Match supplier type to project requirements: head enterprises for turnkey/high-tech solutions, cluster companies for cost-effective standard cranes

- Consider long-term maintenance and local service when selecting smart or automated cranes

- Large-tonnage or specialized cranes often require custom specifications, so early planning with suppliers is crucial

Key Drivers and Challenges

Understanding the forces behind crane exports and the obstacles companies face is essential for buyers who want to make informed decisions. Knowing what drives growth and what could slow delivery or raise costs helps plan purchases, choose the right suppliers, and manage budgets effectively.

Key Drivers

Several factors fueled the strong growth of Chinese crane exports in 2025. These drivers also indicate where buyers can expect better product availability, innovative features, and faster service.

Infrastructure & Industrial Upgrades

Global infrastructure projects and industrial modernization continued to push crane demand. Belt & Road projects, RCEP trade facilitation, port automation, and renewable energy initiatives all contributed to consistent orders.

- Belt & Road projects: Created demand for large-tonnage and smart cranes across Asia, Africa, and the Middle East

- RCEP benefits: Reduced tariffs and simplified logistics boosted Southeast Asian orders

- Port automation & renewable energy: Drove demand for automated, precision, and heat-resistant cranes

Technology Adoption

Advanced technology has become a key differentiator in exports. Smart controls, remote monitoring, automation, and lightweight design are not just premium features—they reduce operational risks and improve efficiency for buyers.

- Smart control systems: Enable precise handling and reduce accidents

- Remote monitoring: Allows operators and service teams to track crane performance from anywhere

- Automation & lightweight design: Improve efficiency and lower long-term energy and maintenance costs

Local Service & Support

Suppliers with overseas subsidiaries and service centers have a clear advantage. Fast delivery, installation support, and easy access to spare parts enhance operational continuity for buyers.

- Overseas service centers: Shorten lead times and provide on-site assistance

- Turnkey project support: Helps buyers implement complex installations smoothly

- Maintenance support: Ensures longer crane life and fewer operational interruptions

Key Challenges

While growth is strong, buyers and suppliers alike face several challenges that can impact price, delivery, and long-term operational planning.

Trade Barriers

Exporting to certain markets requires compliance with international standards. CE, UL certification, anti-dumping investigations, and tariffs increase costs and limit market access.

- CE/UL certification: Necessary for EU and US markets; adds compliance cost

- Anti-dumping duties: Can affect profitability and competitiveness

- Tariffs & import restrictions: Slow market entry and increase costs for buyers

Material Cost Fluctuation

Steel accounts for a large share of crane manufacturing costs. Price swings directly affect margins and may result in higher order costs or delayed delivery if suppliers adjust production schedules.

- Steel price volatility: Can change final crane pricing mid-year

- Impact on mid-sized and standard cranes: Often the most sensitive to cost changes

- Budget planning: Buyers must consider potential adjustments when negotiating contracts

Price Competition and R&D Costs

The market for standard cranes is highly competitive, pushing prices down. At the same time, suppliers investing in smart, automated, or large-tonnage cranes face rising R&D costs. Buyers need to balance price and technology requirements carefully.

- Standard models: High competition lowers prices but may limit supplier options

- Smart/automated cranes: Higher cost due to R&D and technology integration

- Practical takeaway for buyers: Focus on total cost of ownership, not just purchase price

Key Takeaways for Buyers

- Expect premium for smart, automated, and large-tonnage cranes, but gain operational efficiency and safety

- Plan orders with awareness of material cost fluctuations and seasonal project deliveries

- Work with suppliers who have local support and turnkey project experience to reduce delivery and maintenance risks

- For high-volume or standard models, compare multiple suppliers to balance price and reliability

Market Trends

The global crane export market is evolving rapidly, with shifts in regional demand, technology adoption, and service expectations. Buyers who understand these trends can plan purchases strategically, access the right crane type, and optimize operational efficiency.

Market Diversification

Chinese crane exports are no longer concentrated in a few traditional markets. Diversification across emerging economies and infrastructure-focused regions is helping suppliers maintain growth despite slowdowns in mature markets.

- ASEAN, Middle East, Africa, and Latin America are now core growth regions, absorbing high-volume orders and supporting both mid-size and large-tonnage crane demand

- Buyers benefit from faster delivery and competitive pricing in these emerging markets due to localized production and regional trade agreements (e.g., RCEP)

- Diversification also reduces dependency on the US and EU markets, providing more stable supply options

Technology Adoption

Smart, automated, and large-tonnage cranes are taking a growing share of the export market. These technologies improve operational efficiency, safety, and long-term reliability, making them increasingly attractive to buyers.

- Smart cranes: Remote monitoring, anti-sway, and automatic positioning reduce accidents and operational downtime

- Automated cranes: Ideal for ports, container terminals, and industrial projects requiring precise and repeatable handling

- Large-tonnage cranes: Meeting the needs of heavy industry, metallurgy, shipbuilding, and energy projects, often exceeding 20–50 tons

Service and After-Sales Support

Suppliers are recognizing that service is now a revenue driver and a key differentiator in global markets. Buyers benefit from suppliers that provide local support, spare parts, and training, which can reduce downtime and improve long-term ROI.

- Overseas subsidiaries and service centers shorten response time for repairs and maintenance

- Turnkey project support ensures smooth crane installation and commissioning

- After-sales revenue is growing, reflecting buyers' demand for reliability and operational continuity

Product-Market Alignment

Successful exporters are matching crane types to the specific needs of regional markets, rather than offering a one-size-fits-all approach. This alignment benefits buyers by providing cranes optimized for local conditions, industrial scale, and cost structures.

- ASEAN: Mid- to small-tonnage cranes, cost-effective, suitable for warehouses, mid-size factories, and light logistics operations

- EU & Middle East: Smart, precision, and heavy-duty cranes, meeting high safety standards, automation requirements, and long-span industrial needs

Premium Market Access

High-end certifications such as CE (European) and UL (US) are increasingly important for expanding access to premium markets. Buyers targeting regulated or high-end projects benefit from certified cranes that meet international safety and quality standards.

- CE and UL certifications enhance market credibility and open access to Europe, North America, and regulated industrial sectors

- Certified smart and automated cranes often carry higher resale value and operational reliability

- Buyers should consider certification status when planning high-value or safety-critical projects

Key Takeaways for Buyers

- Focus on emerging markets for competitive pricing and faster delivery

- Consider smart, automated, and large-tonnage cranes for efficiency, safety, and long-term value

- Work with suppliers offering local support and turnkey project services

- Align crane type with regional market requirements to maximize operational efficiency

- Prioritize certified cranes (CE/UL) for premium projects or regulated industries

2026 Plans and Buyer Benefits

Looking ahead to 2026, Chinese crane exporters are focusing on market expansion, product innovation, and improved service capabilities. For buyers, these plans translate directly into faster deployment, cost efficiency, higher safety, and future-ready crane solutions. Understanding these trends helps make strategic procurement decisions.

2026 Export and Product Plans

Suppliers are tailoring their strategies to meet evolving market demands and buyer expectations. The focus is not just on volume, but also on technology, flexibility, and service.

Market Focus

Exporters aim to deepen their presence in emerging markets while expanding selectively into regulated and high-value regions.

- ASEAN, Belt & Road countries, Africa, and Middle East: Core growth markets for mid-to-large tonnage cranes and smart solutions

- EU and Latin America: Strategic expansion for high-end, precision, and automated cranes

- This approach allows buyers to access a wide range of crane models with localized support

Product Development

Innovation is targeting both efficiency and adaptability. Suppliers are offering cranes that are smarter, stronger, and more modular.

- Smart and automated cranes: Remote monitoring, anti-sway, automatic positioning

- Large-tonnage cranes: For heavy industry, ports, and energy sectors

- Modular/customized solutions: Adaptable designs for phased project deployment or facility expansion

- Buyers can select cranes tailored to specific project needs, rather than compromising with standard models

Service & Delivery Enhancements

Faster and more reliable delivery is a key focus, supported by expanded service networks and turnkey project offerings.

- More overseas service centers: Shorten lead times and ensure on-site technical support

- Turnkey project support: Includes installation, commissioning, and operator training

- Buyers benefit from reduced downtime, smoother installation, and faster operational readiness

Benefits for Crane Buyers

These 2026 plans translate into tangible advantages for crane buyers, beyond just the purchase itself.

Faster Deployment

Shorter lead times and turnkey installation mean cranes are ready to operate quickly, reducing project delays.

- Buyers can align crane delivery with project milestones

- Turnkey services reduce the need for multiple vendors or technical coordination

Cost Management

New crane designs focus on energy efficiency, lower maintenance, and modularity, which helps manage both upfront and long-term costs.

- Modular cranes allow phased investments rather than a single large outlay

- Energy-efficient motors and automation reduce operational costs over time

- Reduced maintenance requirements minimize downtime and service expenses

Higher Safety and Reliability

Smart technology and heavy-duty designs improve operational safety and crane reliability.

- Anti-sway and load monitoring reduce the risk of accidents

- Remote monitoring allows operators and maintenance teams to detect and address issues before they escalate

- Large-tonnage cranes built for harsh environments ensure consistent performance in demanding projects

Future-Proof Solutions

Crane designs are increasingly Industry 4.0 compatible, supporting digital integration, fleet scalability, and predictive maintenance.

- Buyers can upgrade or expand fleets without major overhauls

- Digital-ready cranes support long-term operational planning and smart factory integration

- Scalable solutions allow adaptation to future project requirements or facility expansions

Practical Takeaways for Buyers

- Align crane type with project needs: mid-size, large-tonnage, smart/automated, or modular

- Choose suppliers with local service centers and turnkey capabilities: ensures faster delivery and technical support

- Consider long-term operational costs, not just upfront price: energy savings, maintenance, and scalability matter

Conclusion

The 2025 export performance for Chinese bridge and gantry cranes highlights key patterns and insights that are directly relevant to buyers. Understanding these trends helps companies make informed decisions about procurement, project planning, and long-term fleet management.

Key Takeaways from 2025 Export Trends

Before diving into next year’s plans, it’s important to summarize what the 2025 data tells us:

- Non-US markets are driving growth: ASEAN, Belt & Road countries, Africa, and the Middle East absorbed the bulk of crane exports, showing steady demand and supporting both mid- and large-tonnage models

- US exports remain weak: Trade barriers, slower industrial investment, and compliance requirements limited growth, highlighting the importance of market diversification for risk management

- Product upgrades sustain competitiveness: Smart, automated, and large-tonnage cranes are gaining market share, helping Chinese manufacturers meet complex project needs and capture higher-value segments

Implications for Buyers

Looking ahead, 2026 plans suggest tangible benefits for crane buyers:

- Focus on smart and large-tonnage cranes: Improved efficiency, operational safety, and suitability for heavy industry projects

- Enhanced localized support: More overseas service centers and turnkey project capabilities mean faster delivery and smoother installation

- Better cost management and scalability: Energy-efficient, modular cranes reduce maintenance and allow future fleet expansion without large upfront investment

For buyers, these trends underscore the importance of aligning crane selection with project requirements, regional market strengths, and supplier capabilities. Those who consider not just upfront costs but also long-term operational efficiency, safety, and scalability are positioned to gain the most from China’s evolving crane export landscape.